How to Easily Create a Schedule of Real Estate Owned (SREO)

As your rental property portfolio continues to grow, answering basic questions such as how much equity you have and what your monthly cash flow is can become increasingly difficult.

That’s why an SREO is a valuable tool for real estate investors to use. The report provides a high-level summary of each rental property and your entire portfolio all in one place.

Key Takeaways

- A Schedule of Real Estate Owned (SREO) lists all of the properties an investor owns.

- An SREO is an important document used by investors, potential business partners, investor friendly real estate brokers, lenders, and underwriters.

- The Schedule of Real Estate Owned includes sections for property information, acquisition, financing, and a monthly pro forma of income, expenses, and cash flow.

- A well prepared SREO can give an investor extra credibility needed when competing with other buyers to purchase a rental property, applying for a new loan, or refinancing.

A schedule of real estate owned (SREO) is a form that lists all properties that an investor has a full or partial interest in, along with the current market values and corresponding debt obligations or mortgage balances.

In one sense, an SREO is similar to having a balance sheet that shows the current real estate equity on both a property and portfolio level. By subtracting current market values from outstanding debt obligations, an investor can easily use an SREO to determine the total net worth of all property owned.

A good schedule of real estate owned also lists the income, operating expenses, mortgage, insurance, and property tax expenses to track the monthly cash flow for each property and for an entire rental property portfolio.

Items Included on a Schedule of Real Estate Owned

Although there is a lot of information on a schedule of real estate owned, the format doesn’t have to be long and complex. There are four main sections to an SREO form:

- Percent Owned : Many real estate investors start out by buying property directly and owning 100% of each property purchased. As more homes are added and real estate portfolios grow, some investors choose to purchase shares of a limited liability company (LLC) or purchase property shares with a fractional ownership interest.

- Property Type : Common types of residential property include single-family rental homes, small multifamily buildings, and short-term rentals.

- Number of Units : An SREO shows the number of units in a multifamily building, along with the current occupancy level of the property.

- Acquisition Date : The month and year that each property was purchased. For fractional ownership shares or investment in an LLC, the acquisition date is based on when the investment was made.

- Acquisition Price : Purchase price of each property or the amount of capital invested in a fractional or group investment.

- Lender : Name of the lender, such as a traditional bank or credit union, portfolio lender, private hard money lender, or the name of the seller if the property financing was provided by the seller (as in a seller carryback).

- Rate : Current interest rate on an outstanding real estate loan expressed as a percentage.

- Maturity : Day, month, and year that the mortgage term ends. By looking at the maturity date, an investor can tell at a glance if a loan should be refinanced based on a change in interest rates.

- Market Value : Value of real estate owned is periodically updated on an SREO using current conditions in the marketplace. By marking each property to market and subtracting the current loan balance, an investor can see the accumulated equity in each property and estimate the amount of cash available to pull out of one property to use as a down payment for more real estate.

- Loan Balance : Outstanding balance may be updated monthly each time a mortgage payment is made.

- LTV : Loan-to-value compares the amount of outstanding debt to the property market value. As property prices increase and mortgage balances are paid down, the LTV will decline as well. Real estate investors generally make a down payment of 25% when purchasing rental property, creating a beginning LTV of 75%.

Monthly Pro Forma

- Income : Includes all scheduled rent payment for each property, plus additional income such as pet rent or appliance rent. Income amounts reported on an SREO can be updated by referring to the most recent rent roll for each property.

- Mortgage : Sum of all scheduled mortgage payments for each property, including first and second mortgages (if applicable). If a property is refinanced or a home equity loan is obtained, care should be taken to update the new monthly mortgage payment as well.

- Property Taxes : Some loan payments include a pro rata monthly amount for property taxes, while other investors pay property taxes directly to the county assessor twice a year. The SREO assumes that property taxes are paid monthly to create a more accurate picture of cash flows.

- Insurance : Homeowner and landlord insurance costs are recorded as a monthly expense, even if premiums are paid on an annual basis.

- Other Expenses : Projected expenses other than the mortgage payment, property taxes, and insurance are included here. Because property operating expenses vary from month to month, some investors update this section on a quarterly or semi-annual basis.

- Cash Flow : Calculated by subtracting the mortgage, property tax, insurance, and other expense payments from the income amount. An SREO will automatically calculate cash flow to ensure that income minus expenses equals cash flow.

How to Prepare a Schedule of Real Estate Owned

While some investors manually create an SREO using a spreadsheet, there’s a new and easier way to get this report created. The first step to preparing a schedule of real estate owned is to sign up for a free account with Stessa . It takes just a few minutes to enter your property address and information, connect bank and lender accounts quickly and securely, and run reports as needed.

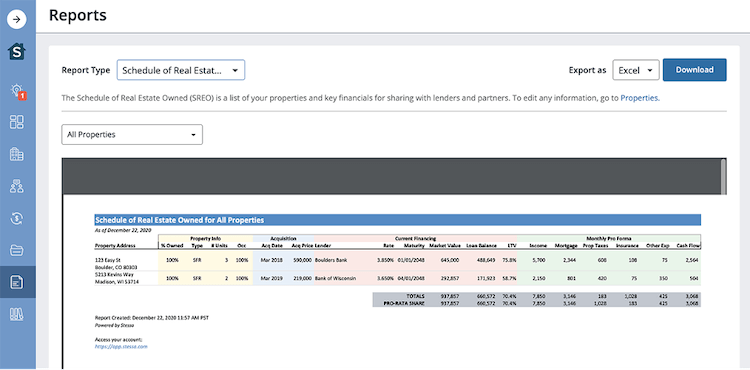

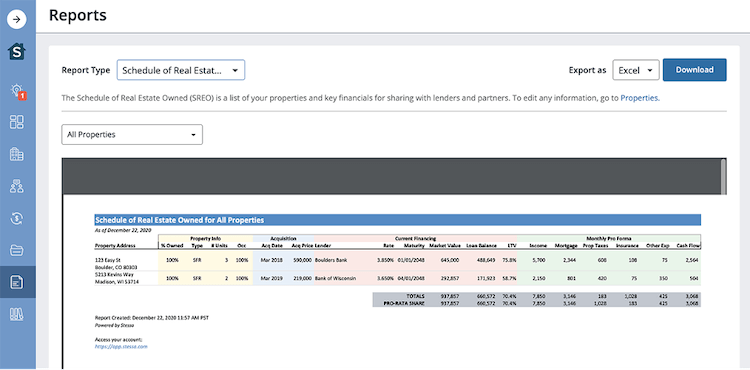

The Schedule of Real Estate Owned is available on the Stessa Reports page. It can be viewed on-screen, downloaded as a PDF, or exported as an Excel file for more flexibility.

The SREO pulls key information from various places across your Stessa account and includes key elements such as:

- Percent of property ownership for each partner is pulled from the Properties page.

- Number of units managed comes from the Leases & Tenants page.

- Acquisition date and price is available via the Properties page.

- Current financing information including the lender, rate, maturity, current market value, and loan balance are all compiled from the Properties page as well. To avoid manually updating loan balances each month, you can connect your Stessa account directly to your lender.

- Income from scheduled monthly rents and other income comes via the rent roll on the Leases & Tenants page.

- Mortgage payments, property taxes, insurance, and other expenses are all pulled directly from the Properties page.

- Cash flow is automatically calculated by subtracting expenses from income and is updated by making edits to the Properties and Leases & Tenants pages.

With Stessa, you also get access to:

- Automated accounting tools: Replace cumbersome spreadsheets and easily track income and expenses. Stessa automates the process of categorizing transactions, reducing time spent on manual data entry.

- Manual expense tracking: Enjoy precise record-keeping of all property-related expenses, from maintenance costs to insurance fees, for a comprehensive view of property expenditures.

- One-click smart receipt scanning: Quickly and accurately add expense receipts to your property records, reducing the risk of losing or misplacing vital receipts.

- Mileage tracking: Track all travel related to your property management efforts for accurate expense reporting. This feature is particularly beneficial for tax purposes, as you can sometimes deduct these costs from taxable income.

- Automated bank feeds: Connect unlimited bank accounts for real-time income and expense tracking so you can manage your cash flow effectively and stay on top of your financial situation.

- Centralized dashboard with key metrics and complete chart history: Access a clear real-time overview of your property performance. The dashboard displays critical metrics and historical data in an intuitive, easy-to-understand format.

- Rental applications: Manage tenant applications efficiently and effectively by streamlining the process of publishing vacancies, and collecting and reviewing applications.

- Tenant screening: Use a proprietary approach with RentPrep for comprehensive tenant checks, including a full credit report, background check, and more. For additional screening, landlords can add income verification or judgment and liens, increasing the odds of selecting reliable tenants.

- Online rent collection: Automate your rent collection process, including payment reminders and late fees, reducing the likelihood of missed or late payments.

- Landlord banking: Open FDIC-insured bank accounts and enjoy a more efficient way to manage your property-related finances. You can also earn more than 10x the national average interest rate on every dollar of deposits.*

- Mobile app (iOS and Android): Utilize Stessa’s mobile app to help you manage your properties on the go. You can categorize transactions, check key metrics, scan receipts, and view your portfolio from almost anywhere, anytime.

- eSigning: Simplify lease signing and other document execution with integrated eSignature capabilities. This feature makes it easier for landlords and tenants to sign important documents, reducing the need for in-person meetings.

- Tax center : Tax time is a cinch thanks to the Stessa Tax Package feature. It helps aggregate your transactions and sends you personalized tax reports via email with digital copies of all of your receipts packaged into a single ZIP file.

Parties Who Use an SREO

An SREO is used by a variety of stakeholders because the report provides an easy-to-understand snapshot of an investor’s entire real estate holdings on both a property and portfolio level.

The schedule of real estate owned is a valuable tool when applying for a new loan on an additional property, or for refinancing an existing mortgage.

By combining current occupancy, debt levels, current property values, and cash flows, anyone reviewing an SREO can gain a great deal of information about an investor’s risk profile as a potential borrower or partner in a group investment.

Parties who use an SREO include:

- Real Estate Brokers : An SREO can demonstrate to a real estate broker that an investor is qualified to purchase the type of property being searched for. Good investor friendly real estate agents often maintain a full client roster, but may be more than willing to make the time to work with a serious real estate investor.

- Investment Partners : As investors scale up and grow their real estate portfolios, many partner with other investors to invest in larger deals or make better use of investment capital. An SREO can give potential partners the confidence they need to invest in a joint venture, or allow an investor with proven experience to become a member of an LLC for real estate investing.

- Lenders : The schedule of real estate owned provides a lender with information not included on a credit report. An SREO makes it much easier for a lender to assess the potential risk of making a loan to a borrower. Investors applying for a blanket mortgage can also use the SREO to give the lender a better idea of the total loan size required and the amount of cash generated from the entire property portfolio that may be used for monthly debt service.

- Underwriters : The SREO is used by underwriters to calculate a borrower’s debt-to-income ratio, which is a main consideration in grading the quality of a loan. A low debt-to-income ratio indicates that there is a good balance between income and debt, while a high debt-to-income ratio is a sign that a borrower may not be able to make the monthly mortgage payments on time over the loan term.

*Stessa is not a bank. Stessa is a financial technology company.Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.